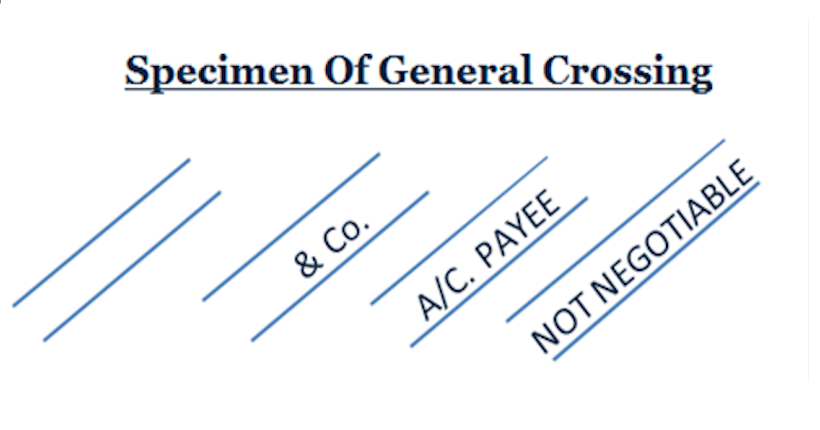

Types of crossing

General crossing

A crossed cheque generally is a cheque that only bears two parallel transverse lines, optionally with the words 'and company' or '& Co.' (or any abbreviation of them) on the face of the cheque, between the lines, usually at the top left corner or at any place in the approximate half (in width) of the cheque. In the UK, the crossing is across the cheque by the person who originally wrote the cheque (the drawer), or it can legitimately be added by the person the cheque is payable to (the payee), or even by the bank that the cheque is being paid into.

Generally-crossed cheques can only be paid into a bank account, so that the beneficiary can be traced.

A crossed cheque on its own does not affect the negotiability of the instrument.

Account payee

Adding a crossing to a cheque increases its security in that it cannot be cashed at a bank counter but must be paid into an account in exactly the same name as that which appears on the ‘payee’ line of the cheque (i.e. the person who has received the cheque, who is legally the “payee” and “holder” of the cheque).

Not negotiable

The words 'not negotiable' can be added to a crossing.

The effect of such a crossing is that it removes the most important characteristic of a negotiable instrument: the transferee of such a crossed cheque cannot get a better title than that of the transferor (cannot become a holder in due course) and cannot convey a better title to his own transferee, but the instrument remains

Restrictive or special crossings

Where some customary instruction is written between the two parallel transverse lines (constituting crossing of cheque) that may result in imposing certain restrictions on the collecting or paying banker, it is called restrictive crossing. The example is "State Bank of India". In these cases, the respective restrictions mandate to pay the cheque through State Bank of India (acting as collecting banker) only.

Specific bank

A crossing may have the name of a specific banker added between the lines. A cheque with a such a crossing can only be paid into an account at that bank.

The beneficiary bank can add an additional crossing to allow another bank, who are acting as their agent in collecting payment on cheques, to be paid the cheque on their behalf.

Sources:

Explanation: Wikipedia

Video: YouTube

0 Comments

Apni aaraa ka izhaar krain, Write comment.....